In 2013, a water source, which could supply Kenya for 70 years was discovered in the arid Turkana region of the country. Turkana is one of the hottest and driest parts of Kenya, and it was hit by a devastating drought in 2012. Many of the region’s inhabitants, who are nomadic herders, became vulnerable to

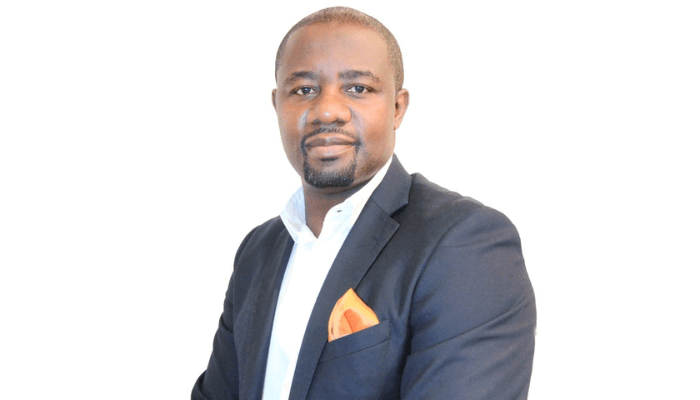

Facctum launches anti-financial crime technology to boosts banks’ risks detention

François Ameguide, Facctum Director of Business Development, Africa Facctum, a risktech company specialising in anti-financial crime solutions, is introducing its next-generation technology to Nigeria. These cutting-edge applications harness the power of parallel processing technology, giving Nigerian financial institutions new choices to modernise financial crime detection. François Ameguide, the Facctum Director of Business Development, Africa said

MTN’s second media fellowship kicks off

The MTN Media Innovation Programme (MTN-MIP-2) kicked off on Monday, 15 May, with 20 selected media professionals in attendance. The Professional Programme which is being organised in collaboration with Pan-African University (PAU) is part of the telecom company’s drive to provide learning opportunities for media professionals in the country and to foster the best practices

SEC grants Volition Cap license to kickstart fund management

Volition Cap, a Nigerian-based asset management company empowering the middle class has secured a fund management license from the Nigerian Securities and Exchange Commission. The license according to the company allows its operations as a registered fund manager in Nigeria, as it prepares to launch a suite of retail and institutional investment products for Africans

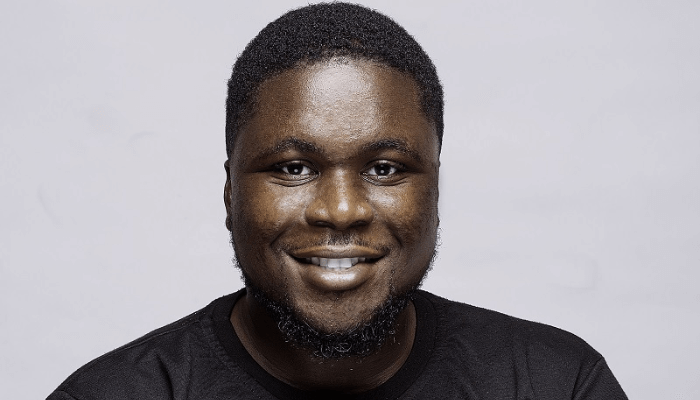

Gricd becomes ‘Figorr’, secures $1.5m seed funding to push insurance for perishable goods

Gricd, a technology company that develops Internet of Things-powered solutions to support the last-mile delivery of perishable goods, has secured $1.5 million in a seed funding round. The funding round was led by Atlantica Ventures, with Vested World, Jaza Rift, and Katapult’s participation to expand across Africa and deliver new solutions that will make it

M-KOPA raises $250m to scale consumer fintech across Africa

M-KOPA, a fintech platform, has announced that it successfully secured $250 million in new debt and equity funding to expand its financial services offering to underbanked consumers across Sub-Saharan Africa. This marks one of the largest combined debt and equity raises in the African tech sector, enabling M-KOPA to continue its rapid growth, the company

Businesses groan as CAC portal creaks

Businesses and corporate lawyers in Nigeria have been beset by several challenges from the Corporate Affairs Commission (CAC) portal, with pressing transactions coming to a standstill as a result. There has been significant downtime on the portal, which barely functions for more than an hour per day. “The portal is usually inaccessible during the day,”

CAC seen as barrier to ease of doing business

As Nigeria’s government continues to face the challenge of making the country more business-friendly across all sectors, the Corporate Affairs Commission (CAC) has been described as a barrier to the ease of doing business in the country. The processes for business incorporation are among the metrics for determining how burdensome or flexible it is to

Bridging the Gap: Gullit VC Launches Startup Accelerator

Africa’s tech landscape is rapidly evolving and so is its startup culture. As a result, many African startups are now taking centre stage, with their innovations and creative ideas gaining recognition on a global scale. From Nairobi to Lagos, young entrepreneurs are leveraging technology to solve local problems and create innovative new businesses. These startups

Can GTCO take on Nigerian fintechs?

In July 2021, Guaranty Trust Bank Plc, one of Nigeria’s foremost lenders, made a corporate reorganization into GTCO, a holding company. This reorganization meant the company would start offering services beyond banking, such as payment service solutions. Now GTCO has released its full-year financial statements for 2022, marking its first anniversary as a holding company.