The juicy foreign exchange earnings of Nigerian banks have come under intense pressure due to low dollar economic activities, BusinessDay’s analysis and expert opinions have said. Available data gleaned from the Nigerian Exchange Group (NGX) showed five banks- Stanbic IBTC Holdings, FBN Holdings, Wema Bank, Guaranty Trust Holding Company, and Union Bank, recorded a decline

Naira falls to N760 per dollar as demand increases

Naira on Wednesday depreciated against the dollar by 0.65 percent as demand rose at the parallel market segment of the foreign exchange (FX) market. During the intraday trading session in some parts of Lagos, Kano and Abuja, the dollar traded at the rate of N760 compared to N750 on Monday and Tuesday. Traders attributed the

Reliance Infosystems earns top award for digital economy contribution

Reliance Infosystems, a Nigerian-based ICT firm with a focus on providing business-to-business digital transformation models and solutions, has won the Business Transformation Company of the Year award. The award was presented at the 14th Africa’s Beacon of ICT Merit and Leadership (ABoICT) Awards organised by the Nigeria Communication Week publication in Lagos. The tech firm

Tingo Group denies fraud allegations, calls Hindenburg’s report “opinion”

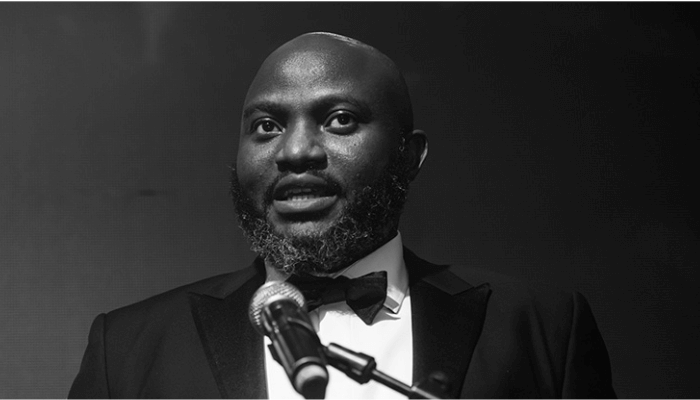

Dozy Mmobuosi, founder and CEO of Tingo Group. Tingo Group, the Nigerian-based agri tech company which came under fire following allegations of fraudulent dealings detailed in a report by Hindenburg Research, an activist investor, has denied any wrong. In a public statement released on Tuesday, the company said the report by Hindenburg only represents the

Phantom airline and false PhD: Who is Dozy Mmobuosi?

Dozy Mmobuosi, the visionary founder of Tingo Group, a rapidly expanding conglomerate encompassing various industries such as technology, agriculture, e-commerce, and aviation, finds himself mired in controversy following a recent news report. Accused of orchestrating an exceptionally apparent scam, with allegations of completely fabricated financials, Mmobuosi’s once-celebrated entrepreneurial journey now faces intense scrutiny and uncertainty.

Trade Lenda nominated for 2023 Go Global Award

Trade Lenda, a Nigeria-based digital bank for SMEs and farmers has announced its nomination for the 2023 Go Global Awards, hosted by the Rhode Island Commerce Corporation. According to the organisers, the Go Global Award is an international event, judged by government officials from over 28 countries alongside influential industry leaders across a spectrum of

Companies mull hybrid work on petrol price hike

Akpan Richard, a 33-year-old employee of a public relations company, woke up on Thursday, 1 June, unwilling to go to work. The recent hike in the price of petrol as a result of subsidy removal by the Nigerian government has changed his life overnight. His monthly budget for transport to and from the office would

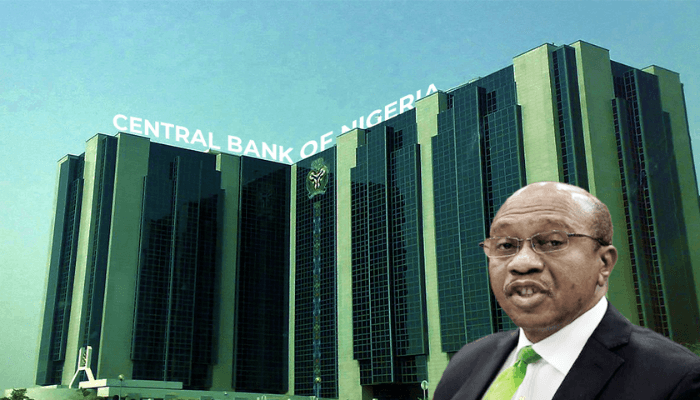

Explainer: Why microfinance banks are endangered species

The Central Bank of Nigeria (CBN) recently revoked the operating licences of 132 Microfinance Banks (MFBs), three finance companies and four Primary Mortgage Banks (PMBs). In September 2010, the CBN revoked the operating licences of 224 MFBs, making a total of 356 of microfinance banks revoked in 13 years by the banking sector regulator. What

Kenyan, South African banks outperform Nigerian peers in ROE

Nigerian banks lagged behind some of their Kenya and South African peers in terms of how much profit they generated with their shareholders’ equity in 2022. Data compiled by BusinessDay showed Nigerian banks recorded an average return on equity (ROE) of 16.50 percent in 2022, lagging behind South African and Kenya peers of 27 percent

Here are top 5 Microfinance Banks

While the wind of economic downtown has swept away some Microfinance Banks (MFBs) in the country, there are others that are meeting the needs of the low-income earners. The top five Microfinance Banks are LAPO MFB, AB, Baobab, Lovonus, Addosser MFB. These banks have distinguished themselves through the adoption of technology in their products and