A few weeks ago, news broke that Silicon Valley Bank (SVB), the widely endorsed bank for most startups and venture capitalists, was shut down by the Federal Deposit Insurance Corporation (FDIC). What triggered the closure was a bank run that began after the bank announced that it lost $1.8 billion in the sale of treasuries and securities. Without clear communication, many customers took those losses as a sign to take their money out of the bank.

Since then, the global tech community has been anything but quiet. Many tech founders, including Africans, are worried about how this situation affects them. Several African startups had funds in SVB as the bank, which served as their lender, required them to keep deposits as collateral in the bank.

SVB is not the only bank that has shut down in the last few days. Silvergate and Signature banks, two of the most important banks in the startup ecosystem, were also involved. But in the middle of this saga, there might be a silver lining for African tech startups. Before we get to that, let’s understand the problem.

Why do African startups use these foreign accounts?

A large portion of African startups raise money from international investors. But after that comes a new challenge: getting that money into their bank accounts. “If you’re a startup from the U.K., you can easily open a U.S. bank account because it’s not a high-risk country. But in Africa, that’s not the case. South Africa is the only country that’s not regarded as high-risk,” Ibrahim Ibitade, co-founder and CEO at Leatherback, told Ventures Africa over a call. “So if an African business goes to the US to raise funds and gets, say, a million dollars from a VC, where would they put that money? The VCs would not move that money into a Nigerian bank account or any other high-risk account.”

As a result, these startups need to open local bank accounts in the US. So, the African company needs to incorporate its business in the US. That explains why many African startups today also identify as US companies.

SVB’s tight KYC (and inclination to reject African startups) may have saved the bulk of Africa’s startup community from taking a direct hit when it folded. But that does not mean there weren’t casualties or that there won’t be indirect effects on the local ecosystem. Whether or not Silicon Valley Bank will recover from its current crisis is uncertain. But it undoubtedly points to the fact that African startups need options.

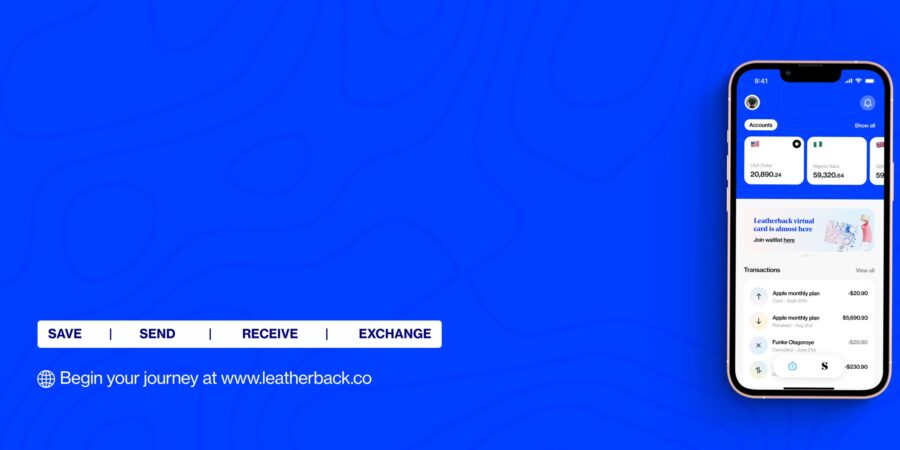

And that’s where Leatherback, a UK-based, Africa-focused financial service provider, comes in. The fintech’s offerings allow African startups to operate bank accounts in multiple countries without a physical presence in those countries. Leatherback is a local digital bank in the UK, and according to Ibitade, it is directly licensed in four countries — the UK, Nigeria, Ethiopia, and Canada — and is about to be licensed in six more. “We are not leveraging on any third-party or middleman to offer these services,” Ibitade said. “We have the same category of license that Mercury, Revolut, Wise, etc. have. Imagine if we were leveraging on Mercury bank. We would be facing the same restrictions that did not allow Mercury bank to service African startups well enough. For instance, Mercury bank won’t offer you exchange services, but we can.” A quick sort code check confirms Ibitade’s assertion of having the same license category as these banks.

How it works

Ibitade took Ventures Africa on a product tour, explaining Leatherback’s advantages over its biggest competitors. The first one that stood out is that unlike local competitors such as PayDay and Fincra, Leatherback uses no third-party leverage. The second one is that it has several advantages over Mercury bank.

Creating an account with Leatherback is easy — pretty much like a regular mobile banking platform. When a startup creates a Leatherback account, it opens a local currency account provided by a local bank. That means users can make and receive transfers from any local bank account to their Leatherback account. For instance, Nigerian users get a Providus Bank account when they sign up.

After creating an account, it’s easy to get multiple accounts in different currencies, such as the Euro, British Pound, US dollar and Indian Rupee. A Canadian dollar offering is also underway as the company recently partnered with People’s Trust bank in Canada.

Exchanging currencies was also a seamless experience as it was fast and free of charge.

But while these features are impressive, none outshines Leatherback’s ability to receive international payments. It removes the hassles of wired transfers by giving you different local options to collect money in your country of choice. That means a Nigerian can use Leatherback to receive local transfers from the United States or the United Kingdom. “Anyone can send money to different countries. But receiving money is the hard part,” Ibitade said. “Yet, collection is key to business expansion. The minute you can collect money from anywhere, you no longer need to go and incorporate your business in these countries. You can sell from where you are.”

Transaction limits are often an Achilles’ heel for fintech products dealing with cross-border payments. But because of Leatherback’s license, there are no limits on how much money users can hold or transact in their accounts. “The typical client that uses a Leatherback account receives from as low as $5,000 to as high as $10 million per transaction,” Ibitade said.

A new dawn?

Leatherback’s solution seems to have arrived just in time for the African market. Its goal was to be the more efficient option for African startups. But now, it might as well be saving the system. Aside from helping startups collect money globally, in the coming months, it will also make its API available for others to build on.

Should Leatherback go viral, it will be a fresh wheel to Africa’s drive to become less dependent. So it might be the lemonade from the SVB lemons after all.