The average age of chief executives is falling — but that isn’t necessarily a bad thing Anyone who has spent the past 20 years climbing the corporate ladder in the hope of scoring the top job, be warned: you may already have missed the boat. A few weeks ago, a 28-year-old was appointed to run

Manufacturers’ unsold goods jump 22% in one year on inflation

Nigerian manufacturers are struggling with rising levels of unsold products with inventory stockpiles rising 22 percent as accelerating inflation erodes household incomes, according to the Manufacturers Association of Nigeria (MAN). In the association’s latest half-yearly review report, inventory of unsold finished products in the manufacturing sector increased to N469.7 billion in 2022 from N384.6 billion

Weekly Economic Index: CBN yields to court orders, Emirates is done with Nigeria, Gaddafi’s missing uranium

CBN bows to the Supreme Court’s order After six long weeks of naira swap tussle, the Central Bank of Nigeria (CBN) finally bows to the Supreme Court’s order to extend the deadline for the use of old naira notes to December 31, 2023. Nigerian residents can now do business with the old banknotes of N1,000,

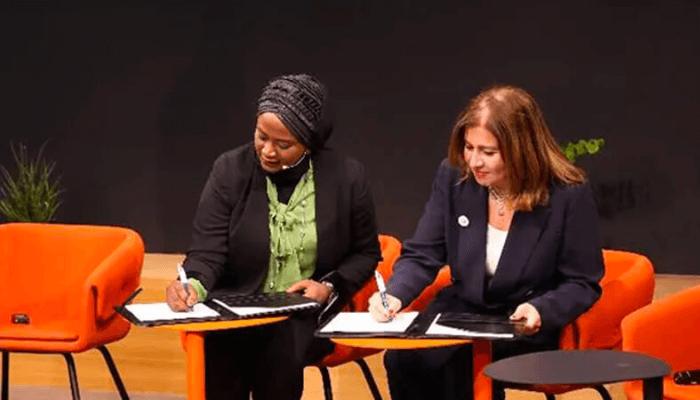

Cisco partners NITDA to accelerate digital transformation in Nigeria

Cisco and the National Information Technology Development Agency (NITDA) in Nigeria have signed a memorandum of understanding (MoU) to support Nigeria’s digital transformation agenda and contribute to digital skills training and development. “Cisco has a responsibility to both its customers and the greater global community to help solve challenges that impact our daily lives,” said

‘Why Faactum solutions will transform Nigerian financial institutions’

Nicholas Willard, head of Business Development, EMEA, Faactum is leading the expansion of the risktech company in Africa’s largest economy, Nigeria. In this interview with BusinessDay’s Frank Eleanya, he speaks about the opportunities its risk analytics technology offers players in the financial services industry to improve compliance and efficiency. Overview of Faactum: Facctum is a

MultiChoice Group launches fintech unit to revolutionise African Payments

MultiChoice Group, the South African media company behind DStv, SuperSport, and other media assets, is launching ‘Moment,’ a payment infrastructure platform dedicated to businesses throughout Africa. In collaboration with two investors, Rapyd and General Catalyst, MultiChoice Group will establish its new fintech joint venture aimed at developing an “integrated payment platform for Africa”. Moment aims

Eurobonds, stocks, naira jump as Tinubu hits ground running

Nigeria’s new President Bola Tinubu is quickly warming himself to investors after wasting no time in announcing an end to the country’s costly fuel subsidy program and unveiling plans to adopt a single exchange rate. Investors are already reacting to Tinubu’s pro-market policies with the country’s dollar bonds rallying. According to Bloomberg data, debt due

Nigeria Eurobonds jump as Tinubu hits ground running

Lolade Akinmurele May 30, 2023 Nigeria’s new President Bola Tinubu is quickly warming himself to investors after wasting no time in announcing an end to the country’s costly fuel subsidy program and unveiling plans to adopt a single exchange rate. Investors are already reacting to Tinubu’s pro-market policies with the country’s dollar bonds rallying. Read

Treasury yield expected to rise on interest rate hike

Treasury bills yield is expected to trend upwards this week at the secondary market, following a hike in the Monetary Policy Rate (MPR) by the Central Bank of Nigeria (CBN). Treasury yield is the effective annual interest rate that the government pays on one of its debt obligations, expressed as a percentage. In other words,

Weekly economic index: CBN’s MFB carnage, Patricia’s hack and Nvidia’s rally

Here are three big stories from Africa’s business landscape you should keep in mind this week: The CBN went on a licence-revoking spree On May 24th, the Central Bank of Nigeria revoked the operating licences of 132 microfinance banks, four primary mortgage banks, and three finance companies. Notably, the CBN’s reasons for this carnage varied