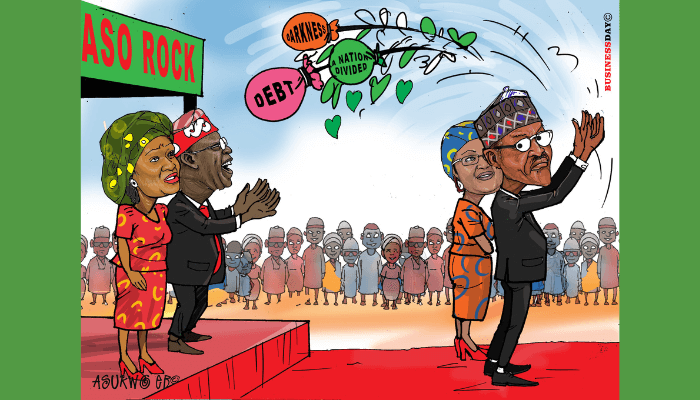

The continued decline in Nigeria’s external reserves despite high oil prices is adding fuel to investors’ fears as it threatens to exacerbate the scarcity of foreign exchange in Africa’s biggest economy. When the incoming government of Bola Tinubu takes over next Monday, one of the most critical tasks it will face is the management of

Low oil, capital flight shrink external reserves

Nigeria’s external reserves have been on a downward trajectory in recent months, driven by low inflows from crude oil sales and foreign capital. The reserves, which gives the Central Bank of Nigeria (CBN) the firepower to defend the naira, declined by 12.70 percent to $35.19 billion as of May 19, 2023 compared to $40.31 billion

Fixing Nigeria’s Economy Series: Tinubu’s knack for A-list team faces biggest test

The work ahead for Nigeria’s President-elect Bola Tinubu requires him to set up a team almost as flawless as the treble-chasing English premier league team, Manchester City. He will also need to be just as ruthless as manager Pep Guardiola or even more, after all governing Nigeria is a more difficult task than winning the

The Buhari Legacy Series: VAIDS – How ambitious tax amnesty scheme was derailed

Launched on June 29, 2017 by President Muhammadu Buhari’s government during a well-attended event at the State House Conference Centre of the Presidential Villa in Abuja, the Voluntary Assets and Income Declaration Scheme (VAIDS) – a tax amnesty programme – sought to boost the country’s very low tax base and shore up revenues. VAIDS is

Lagos issues N134.8bn long-tenure capital market bonds

…..Schools, electricity projects, road construction, Agric among key sectors of focus Governor Babajide Sanwo-Olu of Lagos State Lagos State on Tuesday issued a 10-year bond and a seven-year bond valued at N115 billion at 15.25 percent and N19.815 billion at 14.7 percent, respectively. The total amounted to N134.8 billion. The bonds are part of the

Naira gains across market as dollar demand slows

Naira on Monday strengthened across foreign exchange market segments as demand for dollars by the end users moderated. At the parallel market, popularly called black market, naira appreciated by 0.26 percent as the dollar traded at the rate of N758 on Monday as against N760/$ on Friday. In April, the naira gained 0.67 percent to

Why GDP will decline in first quarter 2023 – MPC members

Ahead of the release of the Gross Domestic Product (GDP) on Wednesday, by the National Bureau of Statistics (NBS), some members of the Monetary Policy Committee (MPC) have highlighted leading indicators of a possible decline in GDP and employment growth in the first quarter (Q1) of 2023. GDP refers to the total market value of

Nigeria’s economy seen shrinking to 1.2% on cash crunch – FDC

The Financial Derivatives Company (FDC) predicts that Nigeria’s GDP will decline to 1.2 percent in the first three months of 2023 compared to 3.52 percent in Q4 2022. The financial institution said in its monthly economic update published May 19 that the forecasted decline in Nigeria’s Q1 GDP will largely be tied to the effect

Why banking sector assets grew by 25.34% in 1year – MPC members

Nigeria’s banking sector assets rose by 25.34 percent (N9.98 trillion) between the end of February 2022 and 2023, driven largely by balances with the Central Bank of Nigeria (CBN)/banks, FGN bonds, Treasury Bills and credit, according to members of the Monetary Policy Committee (MPC) in their personal statement at the last meeting in March, 2023.

World’s toughest job awaits Tinubu

“Whoever wins this election, loses.” Those were the words a foreign diplomat who has lived in Nigeria for 20 years used in depicting the arduous task ahead of Nigeria’s next leader and it is the reason many believe President-elect Bola Tinubu must hit the ground running from day one. Tinubu, whose victory is still being