The Non-Performing Loans (NPLs) of deposit money banks, also known as bad loans, have declined to lowest in seven years, indicating the healthy status of the financial institutions. Data from the National Bureau of Statistics (NBS) and the Central Bank of Nigeria (CBN) show that the ratio of banks’ NPL has dropped by 10.61 basis

First negative FDI in 33yrs piles pressure on Tinubu

Foreign Direct Investment (FDI) inflows into Nigeria turned negative last year for the first time in at least 33 years, according to new data from a United Nations agency, representing one of the major challenges inherited by President Bola Tinubu. Tinubu, who took the helm of Africa’s biggest economy just over a month ago, has

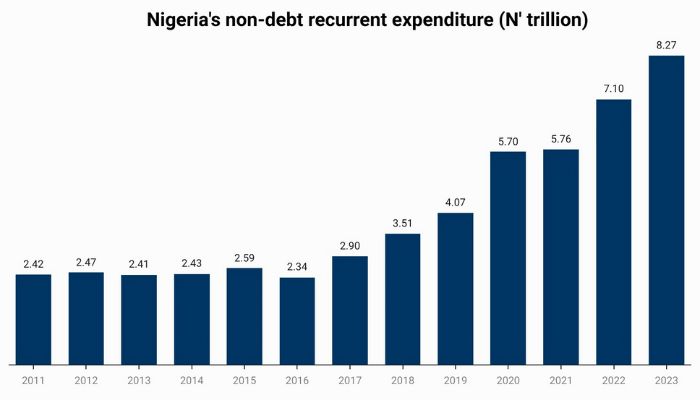

FG’s 241% recurrent budget bump exposes bloated bureaucracy

The federal government increased its budget for personnel expenses, pensions and other recurrent expenditure by 241 percent in 13 years, a development that dampened economic growth and impoverished millions of its people. Data obtained from the government’s official documents showed the government increased its non-debt recurrent expenditure from N2.4 trillion in 2011 to N8.27 trillion

CBN’s unsettled FX backlog puts investors on hold

The Central Bank of Nigeria (CBN)’s gaping unsettled foreign exchange backlog owed to local businesses is hurting confidence in its latest currency reform and threatens to shut out foreign investors from the market. The apex bank used to sell about $200 million in FX forward contracts every two weeks but soon ran into troubled waters

Global race for talent heightens ‘japa’ wave

The global race for talent looks set to ramp up the exodus of Nigerian professionals as Canada and Germany recently eased their immigration laws to lure in more skilled workers from other countries. As their aging population and low fertility rates continue to shrink their workforce, a number of developed countries are turning to largely

How Nigeria can turn brain drain to gain

When Bill Gates, Microsoft’s co-founder, visited Nigeria last month, he said the current migration of young Nigerian professionals was good and healthy for the economy. According to Gates, the rapid surge in immigration has significant benefits, as it contributes to the development of world-class skills and the capacity to repatriate much-needed foreign exchange to grow

Banks’ credit rises by N4.54trn in one year

The banking industry total credit increased by N4.54 trillion or 17.40 percent between the end of April 2022 and the end of April 2023, reflecting increased industry funding base and adherence to the Central Bank of Nigeria (CBN)’s Loan to Deposit Ratio (LDR) directive. The sector’s total gross credit increased from N26.10 trillion in April

Oronsaye report to test Tinubu’s cost-cutting champions

During a budget consideration meeting three years ago, Femi Gbajabiamila, the then Speaker of the House of Representatives, called for deep cuts to governance costs. Today as the president’s chief of staff, he has more clout in the corridors of power. “We recognise that we cannot accomplish these objectives using loans and outside financing alone.

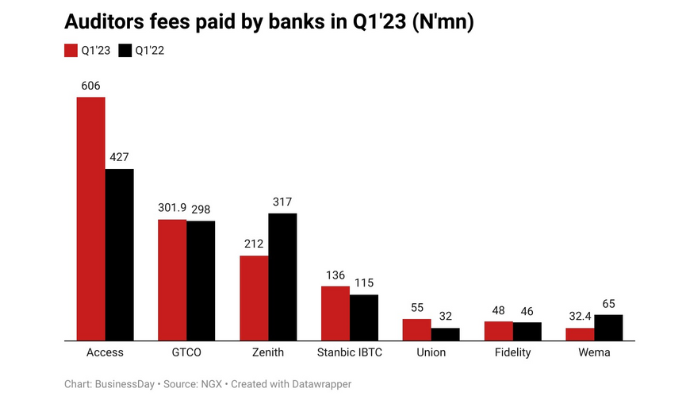

Nigerian banks pay N1.39bn as audit fees to PwC, KPMG, EY, Deloitte

Seven commercial banks listed on the Nigerian Exchange Group paid a total of N1.39 billion to auditing firms in the first quarter of 2023. In Africa’s biggest economy, publicly listed companies are legally obliged to subject their accounts to scrutiny and audit by independent auditors such as PwC, KPMG, EY, and Deloitte, generally called “the

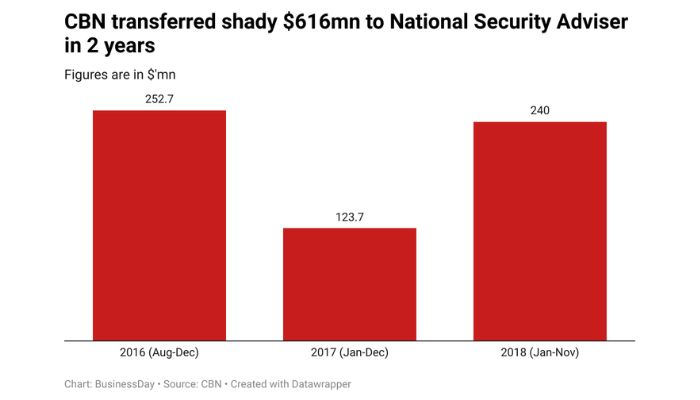

CBN, NSA silent after BusinessDay exposes $616m dark dealings

The Central Bank of Nigeria (CBN) and the Office of the National Security Adviser (NSA) are silent over transfers totalling $616 million (N426 billion at today’s exchange rate) that exchanged hands between them in back-door dealings in two years. BusinessDay had exclusively reported on June 28 that the CBN transferred the amount between August 2016