Facctum, a risktech company specialising in anti-financial crime solutions, is introducing its next-generation technology to Nigeria.

These cutting-edge applications harness the power of parallel processing technology, giving Nigerian financial institutions new choices to modernise financial crime detection.

François Ameguide, the Facctum Director of Business Development, Africa said “We are excited to announce the launch of our new FacctList watchlist management solution that will revolutionise the way Nigerian financial institutions manage mission critical sanctions and anti-terrorism financing risk data.

“It will enable a rapid response to high velocity changes in regulatory obligations, as well as providing new levels of transparency in risk decisioning. This approach provides Nigerian firms with a new approach to demonstrate the strength of compliance controls, both to regulators and international partners.” he said.

Read also: FMDQ Exchange admits Hartleys Supermarket & Store Commercial Paper on its platform

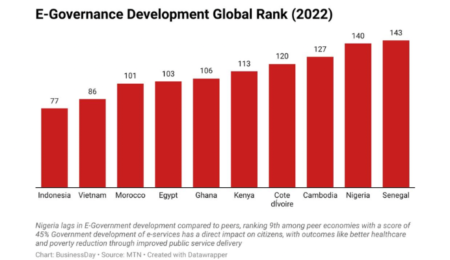

As the Nigerian financial service industry adjusts to a new risk environment, following the recent grey-listing of the country by the Financial Action Task Force (FATF), the Facctum initiative offers highly performant technology that is also affordable and sustainable.

To better service customers in Africa, Facctum opened its first office in the region earlier this year, in Johannesburg. Facctum now plans continued expansion in Africa by placing a strategic focus on serving Nigerian financial institutions and regtechs.

Speaking on its Africa growth initiative, Nicolas Willard, the Facctum Director of Business Development – EMEA, said, “we are delighted to bring anti-financial crime solutions much closer to the Nigerian financial and fintech industry. Nigerian institutions are growing quickly and modern risk management technology plays a critical role in ensuring that new opportunities are both safe and sustainable.”

Facctum uses a combination of cloud and state-of-the-art parallel processing technology to deliver financial crime compliance solutions to regulated industries. The focus on cloud technology results in solutions that can be delivered very economically, whilst also ensuring high levels of security and performance. This approach makes Facctum solutions very relevant to the risk profile and compliance objectives of African financial institutions.