Nigeria’s manufacturing sector growth has slowed to the lowest in three years on account of a cash shortage that crippled the economy during the period.

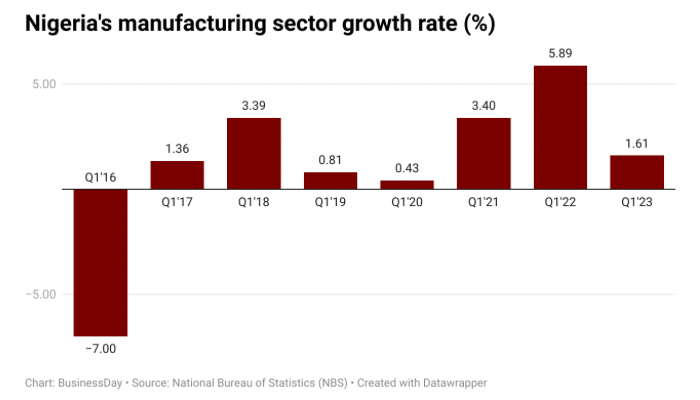

According to the new Gross Domestic Product (GDP) report by the National Bureau of Statistics (NBS), the sector grew by 1.61 percent (year-on-year) in real terms in Q1 2023, down from 2.83 percent in Q4 2022 and 5.89 percent in the same period last year.

The trade sector also slowed to 1.31 percent in Q1, the lowest in two years from 4.54 percent in the previous quarter and 6.54 percent in Q1 2022.

These sectors contributed to the overall decline in Nigeria’s GDP growth as it fell to 2.31 percent in Q1, down from 3.52 percent in Q4 2022 and 3.11 percent in Q1 2021.

“The reduction in growth is attributed to the adverse effects of the cash crunch experienced during the quarter,” the NBS said.

It said although the growth of the industry sector improved to 0.31 percent relative to the 6.81 percent recorded in Q1 2022, agriculture, and the industry sectors contributed less to the aggregate GDP in the quarter under review compared to Q1 2022.

Since the beginning of the year, Nigerians have been buffeted by a chronic shortage of cash caused by the naira redesign policy of the Central Bank of Nigeria (CBN). This has disrupted economic activities and negatively impacted the livelihoods of Nigerians.

Data from the CBN show that the currency in circulation dropped to the lowest level in 14 years and five months to N982.1 billion in February from N1.39 trillion in the previous month.

Read also: UK’s new visa policy on students’ dependents sparks ‘japa’ debate

But it rose by 71.41 percent to N1.68 trillion in March after the CBN moved naira notes from its vault to deposit money banks in response to the Supreme Court order to extend the legal tender status of the old N200, N500, and N1,000 notes to December 31, 2023.

“Every aspect of the economy was affected by the cash crunch. So whether you are a small-scale retailer by the roadside or services, the cash crunch reduced the GDP of the country significantly,” Gabriel Idahosa, deputy president of Lagos Chamber of Commerce and Industry, said.

He said manufacturers were the worst hit because they already carried trunk costs like raw materials and warehouses full of goods.

“So, it is not a surprise that we have such an impact on manufacturers.”

But Idahosa expects the sector to improve in the second quarter as money gradually comes into the economy.

The latest monthly Purchasing Managers’ Index (PMI) by Stanbic IBTC Bank improved to 53.8 last month after contracting in March (42.3) and February (44.7).

Readings above 50.0 signal an improvement in business conditions, while readings below 50.0 show deterioration.

In February, the Manufacturers Association of Nigeria (MAN) told BusinessDay that they are already seeing a drastic reduction of more than 25 percent in sales of locally manufactured products.

“What should ordinarily be a welcome monetary policy to improve the CBN management of naira currency has become enmeshed in tardy implementation and needless disruption of businesses and everyday life of the people,” Segun Ajayi-Kadir, director-general of MAN, said.

A recent report by SBM Intelligence which engaged 46 businesses across the five geopolitical zones showed that 76 percent of business owners were impacted by the naira crunch.

“From egg producers stuck with their produce to rice traders who had to bring down their prices to make sales, most of the business owners interviewed said they were negatively affected by the cash shortage,” it said.