Small and medium enterprise (SME) businesses in Nigeria need a favouable market environment to facilitate growth and survival in the economy.

Enyioma Madubuike, chief legal and compliance officer at Kora said this during an interview with BusinessDay.

According to him, the government should focus on creating a conducive market for merchants to conduct their business smoothly.

“Some of which include loosening restrictions, investing in market-enabling infrastructure such as electricity and commercial road networks, and providing targeted manpower development. By nurturing a conducive ecosystem, governments can empower startups and small businesses, fostering economic,” he said.

Read also: Open banking seen boosting Nigeria’s fintech growth

During the interview, he said Kora is addressing payment difficulties by providing a solution that allows both local and global businesses to accept payments and process payouts through various popular payment channels across Africa.

In other to enable merchants to carry out international transactions, he said, “We recently launched the USD card-acquiring service that enables businesses to scale globally as it opens up opportunities for businesses to enter markets they would have been excluded from without this product.”

“We also have the USD card issuance product that enables us to issue USD-denominated cards to merchants who make dollar payments or merchants who further issue the dollar cards to enable their customers to make dollar payments,” Madubuike said.

Responding to how the unified exchange rate can impact virtual card operations in Nigeria, he said “I believe it opens up the market even more as banks are now able to participate as partners in deepening the virtual cards space.”

“Particularly because of the loosening of the restrictions around the dollar transactions in domiciliary bank accounts, in line with the Central Bank of Nigeria guideline, regarding operational changes to the foreign exchange market,” he said

The policy changes aim to promote transparency, liquidity, and price discovery in the FX market to improve supply, discourage speculation, enhance customer confidence, and ensure overall stability.

In his response on how fintech companies can address the growing concerns around data privacy and security, he said data privacy and security are core parts of providing financial services.

“To provide financial services, you need valuable customer data. Because it is valuable, you must ensure that the data provided to you is secured as you build the customer’s trust not only in your capacity as a business but in the system as a whole,” Madubuike said.

According to Kora CLO, access to data is a key element for innovation, proper data handling must be a primary concern for any financial services provider.

Nonetheless, payment technology is expected to adapt to the changing needs and expectations of younger generations, such as Gen Z and millennials.

“These generations value global connectivity, mobility, and diverse experiences. Payment platforms must cater to their preferences by providing access to global systems and delivering seamless, user-friendly experiences,” he said.

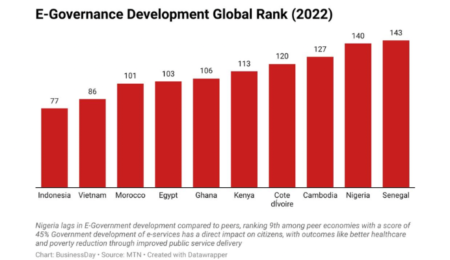

In his response on what Nigeria’s payment ecosystem looks like, and its comparison with other African countries. Madubuike said Nigeria’s payment ecosystem stands out as one of the most advanced and innovative.

“Over the past two decades, Nigeria has transitioned from a system dominated by legacy institutions to one driven by dynamic newcomers continuously introducing innovative products.”

“This rapid evolution positions Nigeria as a leader in the African fintech landscape, showcasing the country’s commitment to driving financial inclusion and revolutionising payment solutions,” he said.