Nigerian Eurobonds jumped on Monday as foreign investors interpreted the suspension of central bank governor Godwin Emefiele as the end of the country’s multiple exchange rate practice.

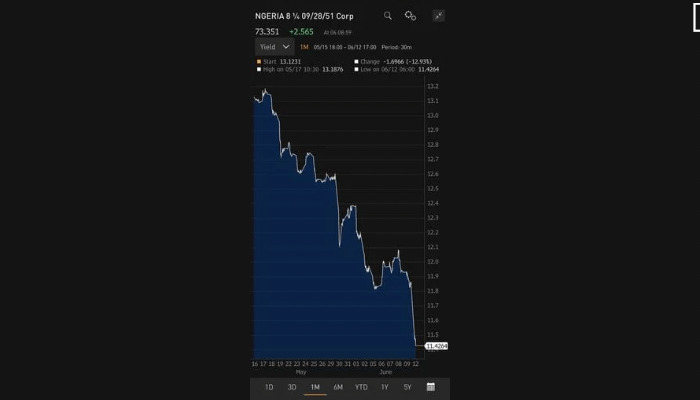

The Eurobonds rose as much as 2.6 cents on a dollar, the most since late January, according to data from Bloomberg.

Longer-dated maturities saw the biggest gains, with the Eurobond maturing in 2049 rising 2.353 cents to 80.231 at 0746 GMT.

Read also: FBN Holdings Q1 profit hits decade high on rising interest income

CBN governor Godwin Emefiele’s suspension late last Friday came as no surprise to many after new President Bola Tinubu had criticised Emefiele’s handling of the naira and monetary policy at his inauguration two weeks ago.

“We believe the changes signal a new era of focused, predictable monetary policy and a shift towards non-interventionism in the foreign-exchange regime,” Barclays economist Michael Kafe said in a note to clients on Monday.

Investors may not have to wait much longer for the much expected unification of the exchange rates which Tinubu promised during his inauguration day speech on May 29.

That’s after Wale Edun, an influential member of Tinubu’s government said Monday that Nigeria will unify the rates “imminently.”

The stock and fx markets are expected to follow suit with gains when the markets reopen Tuesday.

More details to come…