Here are three big stories from Africa’s business landscape you (probably) didn’t miss but should keep in mind this week:

CBN’s new transaction limits

Last week, the Central Bank of Nigeria (CBN) introduced new transaction caps for contactless payments, in a bid to revolutionize the payments landscape in the country. Under the new regulations, contactless payments are limited to a maximum of ₦15,000 per day, with a cumulative cap of ₦50,000. This cautious approach ensures that even in the unfortunate event of unauthorized access to your card, potential losses are minimized. However, larger purchases can still be made through contactless means. To do so, one needs to provide additional information, like your PIN or fingerprint, adding an extra layer of protection to your financial transactions.

The CBN’s decision isn’t merely about security; it’s also a stride toward sustainability. By encouraging contactless payments, they reduce reliance on cash and cards, contributing to a greener environment. Contactless transactions are a step forward in modernizing payments and signify Nigeria’s readiness to embrace innovation and technology.

Palmpay hits 25 million users

PalmPay, one of Africa’s leading fintech platforms, has been gaining attention in the financial space. Last Thursday, they shared some impressive numbers highlighting their rapid growth and impact across the continent. With a whopping 25 million users, 500,000 mobile money agents, and 300,000 merchants, PalmPay has become a major player in the payments industry. PalmPay’s success can be attributed to its smart strategy and ability to adapt. Back in 2019, they secured a significant investment of $40 million, which helped them develop a modern and efficient payment system. This system addressed the challenges faced by unreliable financial systems in Africa. When Nigeria experienced a cash crunch in January 2023, PalmPay stood out as one of the most reliable platforms, and gained popularity, which helped expand its user base.

In addition to their banking solutions for businesses, PalmPay also introduced a savings service with an attractive 20% annual interest plan for all users. This has provided a stable and promising platform for users to grow their finances. While there may be concerns about sustainability given the current economic climate in Nigeria, PalmPay’s ability to adapt and grow reflects the changing financial landscape in Africa.

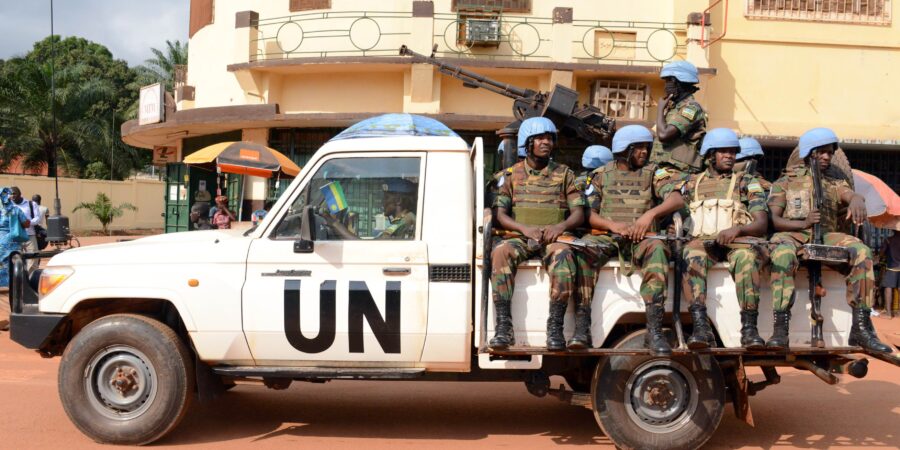

No peace for Malians?

In a dramatic turn of events, the United Nations Security Council has ended a long-standing peacekeeping mission in Mali. The decision came as the ruling military in Mali demanded the immediate withdrawal of the international force engaged in combating an armed rebellion. The peacekeeping operation, aptly named MINUSMA, had been in action for over a decade, but its presence had become increasingly strained due to governmental restrictions and simmering tensions.

This development can be traced back to Mali’s collaboration with Russia’s notorious Wagner mercenary group in 2021, a move that severely limited the effectiveness of peacekeeping efforts on both the air and ground. Recognizing the need to bring this troubled chapter to a close, the 15-member Security Council unanimously adopted a resolution, drafted by France, which outlined the orderly and safe withdrawal of MINUSMA’s personnel. The mission is slated to conclude its operations and transfer its responsibilities by December 31, 2023.

The departure of UN peacekeepers has raised concerns among experts who fear that Mali’s ill-equipped army will be left to combat armed fighters who control vast stretches of territory in the northern and central desert regions. With only approximately 1,000 Wagner fighters remaining, the security situation could potentially deteriorate further, endangering the lives of civilians caught in the crossfire.

ICYMI: Market roundup

- Nigeria’s equities market edged upwards over a 5-day trading week, with the NGX All-Share Index appreciating by 2.98% to close at 60,968.27 points. The top gainers were Ikeja Hotel plc (33.00%), Transcorp Hotels plc (32.95%), Eterna plc (32.49%), Sterling financial holdings company plc (30.74%), and Chams holding company plc (29.82%). The top decliners were Secure Electronic Technology plc (-13.16%), Guinea Insurance plc (-12.50%), universal Insurance (-12.50%), Sovereign Trust Insurance plc (-10.91%), Pharma- Deko Plc (-10.00%).

- The naira closed the week at N769.25/$ on Friday at the investor’s and Exporters’ window.

- Brent crude closed the week at $74.90, while US West Texas Intermediate (WTI) crude closed at $70.64.

- The global cryptocurrency market cap stood at $ 1.2 trillion, as of 8 pm Sunday, the 2nd of July. Bitcoin stood at $30,541.91, a 0.29% increase over the week, while Ethereum gained a little momentum over the week by 1.01% to trade at $1,912.13 and Binance coin increased by 2.59% over the week, to trade at $244.36.

- Last week, Kenyan fashion e-commerce startup ShopZetu raised a $1 million pre-seed funding round to add beauty and home décor categories to its portfolio. The pre-seed round was led by Chui Ventures, with participation from Launch Africa, Roselake Ventures, and Logos Ventures.

- Healthtech startup, Berry Health, raised $1.6 million in a pre-seed round to mitigate stigma in Africa, starting with Ghana. Lightspeed Ventures and General Catalyst co-led the round with participation from Jen Wong, Demetri Karagas, Steven Gutentag, Betsy Zimmerman, and Regina Benjamin.

- Aruwa Capital Management, an early-stage growth equity and gender lens fund, invested $2 million in a Nigerian confectionery manufacturer, Fastizers, to expand its product offerings in Nigeria