Opay, a fintech company with a primary presence in Nigeria recently partnered with Guinness Nigeria to make payments and distributions seamless.

The fintech company disclosed that the partnership which has opened great opportunities that it envisioned was designed to address the cash constraints in the value chain and also scale up its revenue, especially when sales and revenue in the Fast-Moving Consumer Goods (FMCG) manufacturing business crashed. This is because a whole lot of consumers could not get money to pay retailers, retailers could not pay and wholesalers could not pay distributors.

“A digital payment solution was imperative to solve the problem. Opay has always had a digital payment solution in the country recognising that we are a country with a large informal trade. We need to make the distribution channel more efficient in terms of payment. What Guinness did was that when they came to us with that challenge, we actually validated the bespoke solutions which we had and put it in place for Guinness which today we are mutually very proud of. We believe that the channel in terms of go-to-market has been made more efficient because of the wholesale, retail, distribution payment solution that Opay has put in place which is tightly integrated into Guinness itself as the channel capitaines of manufacturers,” Olu Akanmu, co-CEO, Opay said.

SimilarWeb, a finance app tracking platform in its recent data report ranked Opay as the most popular finance app in Nigeria, among over 50 apps ranked.

Read also: Legends of Alkebulan: Story of African deities told with fusion of art, technology

According to Akanmu, a partnership with Guinness is a validation for the FMCG payment solution for Opay which can be a standard for digital payment in the distribution channel for many manufacturers in Nigeria.

“When a leading manufacturer like Guinness embraces complete wholesale and the solutions that were put in place, we can take that solution as a kind of standard for digital payment in the distribution channel for a whole lot of manufacturers in Nigeria. Since we started, especially in this period of limited cash, we have seen a lot of transaction surge, we have responded and for us revenues have been good. That is far less important than the fact that we solve problems for our customers. As more people embrace digital channels, that will be a solution that we need to continuously scale as we go into the future together.”

In 2020, Opera, the parent company of Opay reported that Opay’s monthly transaction grew 4.5x to over $2 billion. Opay also said it processes about 80 percent of bank transfers among mobile money operators in Nigeria and 20 percent of the country’s non-Marchant point of sales transaction

Tajudeen Ibrahim, a research analyst said the partnership is a positive development for the FMCG market in general.

“They learnt the idea from the cash crunch which dampened the performance of FMCG companies generally. So this is a solution for them to ensure that consumers can easily pick the products and pay.

For FMCG companies generally, it is likely they will all adopt similar practices. I noticed that beer companies generally were more affected compared to other FMCG companies, so there will be more of this between payment companies and FMCG.”

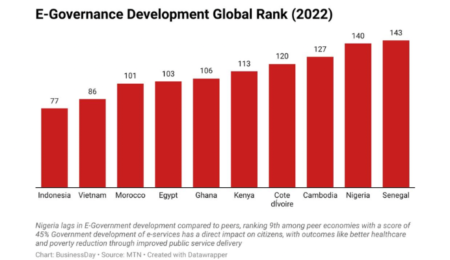

The analyst said there will likely be more future partnerships with telecom companies, particularly given the PSB license in that space. Nigerians may be able to perform transactions with their mobile money. Such partnerships will spring up in the future due to the payment service business.

The FMCG industry in Nigeria is worth $20 billion, with a Compound Annual Growth Rate (CAGR) of 9 percent over the forecast period, according to WigmoreTRADING analysis. The analysis shows that the country’s FMCG market is expected to grow at a CAGR of 10.9 percent during 2019-2024. FMCG products account for more than 38 percent of the total retail sales in the Nigerian market. The growth is driven by an increasing number of high-income households, rising urbanisation coupled with growing health consciousness among consumers.